Functional House Layout Plans for Practical Living

- Efficient House Layout Plans for Modern Living

- Spacious House Layout Plans for Family Comfort

- Contemporary House Layout Plans for Stylish Homes

- Functional House Layout Plans for Practical Living

- Custom House Layout Plans for Personalized Spaces

- Open Concept House Layout Plans for Airy Interiors

- Cozy House Layout Plans for Comfortable Living

- Affordable House Layout Plans for Budget-Friendly Homes

- Luxury House Layout Plans for Upscale Living

- Versatile House Layout Plans for Multi-Purpose Spaces

- Sustainable House Layout Plans for Eco-Friendly Living

- Traditional House Layout Plans for Timeless Charm

- Compact House Layout Plans for Small Spaces

- Spacious One-Level House Layout Plans

- Two-Story House Layout

Say Goodbye to Clogged Drains Shower Cleaning Guide

Keep Your Drain Clear: Shower Cleaning Tips

Introduction

Keeping your shower drain clear is essential for maintaining a clean and functional bathroom. Clogged drains can lead to unpleasant odors, slow drainage, and even water damage if left unattended. In this article, we’ll explore effective tips and methods to keep your shower drain free from blockages and running smoothly.

Regular Cleaning Routine

One of the best ways to prevent clogs in your shower drain is by establishing a regular cleaning routine. Make it a habit to clean your drain at least once a month to remove any buildup of hair, soap

Stunning Mansion House Blueprints for Your Dream Home

Luxurious Mansion House Plans for Modern Living

Introduction

In the realm of architectural excellence, few things exude opulence and grandeur quite like mansion house plans. These meticulously crafted blueprints are not just about size; they represent a lifestyle, a statement of luxury and sophistication. Let’s delve into the world of mansion house plans and discover what makes them so appealing to those seeking the epitome of modern living.

Timeless Elegance and Spacious Designs

One of the defining features of mansion house plans is their timeless elegance. These designs often incorporate classical architectural elements such as columns, arches, and intricate detailing,

Lush Tropical Indoor Plants Greenery for Your Home

Tropical Indoor Plants: Transforming Your Home into a Green Paradise

Discover the Beauty of Lush Tropical Indoor Plants

Tropical indoor plants bring a touch of exotic beauty to any home. With their vibrant colors, lush foliage, and unique textures, these plants create a tropical paradise right in your living space. Whether you’re a seasoned plant enthusiast or a beginner, there’s a wide variety of tropical plants to choose from, each offering its own charm and benefits.

Benefits of Indoor Tropical Plants

Aside from their aesthetic appeal, indoor tropical plants offer numerous benefits. They improve indoor air quality by purifying the

Proactive Strategies for Effective Kura Home Maintenance

Expert Tips for Year-Round Kura Home Maintenance

Introduction: Mastering the Art of Kura Home Maintenance

Maintaining your Kura home throughout the year is more than just a chore; it’s an investment in the comfort, safety, and longevity of your living space. With the right approach and a proactive mindset, you can ensure that your home remains in top condition, regardless of the season. Here, we’ll explore expert tips and strategies to help you master the art of year-round Kura home maintenance.

Prioritize Peace of Mind with Regular Inspections

Regular inspections are the cornerstone of effective Kura home maintenance. By identifying

Upgrade Your Bathroom Shower Drain Extension Ideas

Introduction:

Shower drain extension might not be the first thing that comes to mind when renovating your bathroom, but it’s a crucial element that can make a big difference in both functionality and aesthetics. In this article, we’ll explore the importance of shower drain extensions and provide practical tips for installation and maintenance.

Understanding the Need for Shower Drain Extension:

The standard shower drain location may not always align with the design or layout of your bathroom. This can lead to water pooling or drainage issues, making it essential to extend the drain to ensure proper water flow and prevent

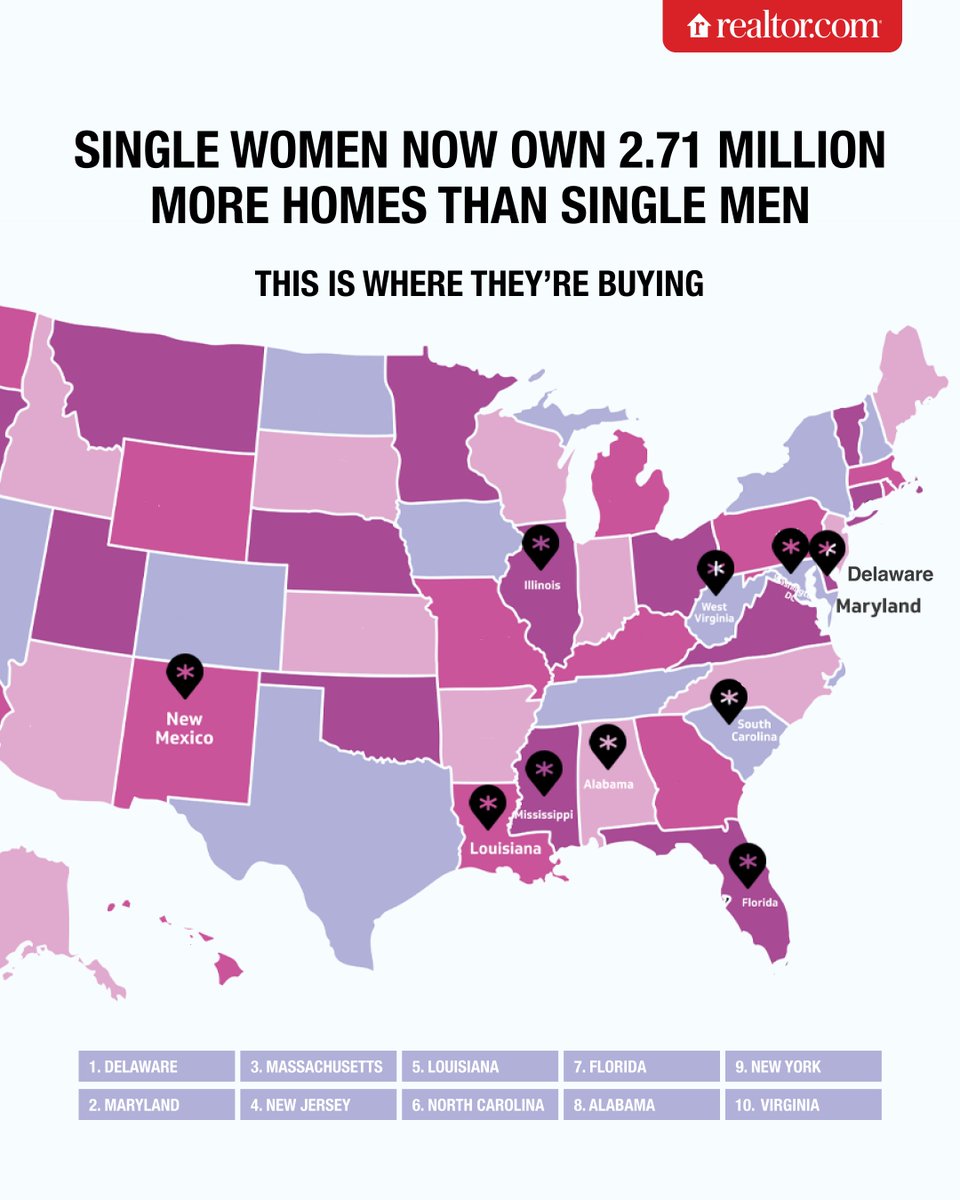

Realtor.com Your Source for Real Estate Information

Certainly! Here’s the article based on the title provided:

Exploring the World of Realtor.com

Your Ultimate Guide to Real Estate Search

In the vast world of real estate, finding the perfect home can feel like searching for a needle in a haystack. Thankfully, platforms like Realtor.com exist to simplify this process and connect homebuyers with their dream properties. Let’s delve into what makes Realtor.com the go-to destination for all things real estate.

Comprehensive Property Listings

One of the standout features of Realtor.com is its extensive database of property listings. Whether you’re looking for a cozy starter home, a luxurious estate,

Signature Style Comfortable Luxury in Jean Stoffer

Rustic Elegance in Jean Stoffer Home

Unveiling the Charm of Jean Stoffer’s Designs

In the realm of interior design, Jean Stoffer has carved a niche for herself with her signature style that blends rustic charm with timeless elegance. Let’s delve into the essence of Jean Stoffer Home and explore what sets her designs apart.

Modern Farmhouse Chic by Jean Stoffer

Exploring the Fusion of Modernity and Farmhouse Aesthetics

Jean Stoffer’s take on modern farmhouse chic is nothing short of captivating. She seamlessly integrates modern elements with rustic farmhouse aesthetics, creating spaces that are both stylish and welcoming.

Timeless Beauty of

Expert Plumbing Solutions for North Coast Residents

The North Coast Plumbing Experts You Can Trust

Expertise You Can Rely On

When it comes to ensuring your home runs smoothly, few things are as essential as a reliable plumbing system. From ensuring your morning shower is warm to keeping your kitchen sink flowing freely, a functional plumbing system is the backbone of any household. Here on the North Coast, where weather conditions can be unpredictable and homes vary in age and style, having a trusted plumbing expert is invaluable.

Emergency Services When You Need Them

We understand that plumbing emergencies can strike at any time, and when they

Transform Your Space with Lowe’s Remodeling Services

Transform Your Space with Lowe’s Remodeling Services

Introduction

Lowe’s has long been a trusted name in home improvement, and their remodeling services are no exception. If you’re looking to transform your living space into something truly special, Lowe’s has the expertise and resources to make it happen.

Expert Renovation Solutions

One of the key advantages of choosing Lowe’s for your remodeling needs is their team of expert renovation specialists. These professionals bring years of experience and knowledge to every project, ensuring that your vision for your home becomes a reality. Whether you’re looking to update a single room or completely